The competition for talent in advancement services and development operations is steep. There is no standard educational path to these positions. No one goes to college to run data and gift management for a university. The skills needed also go well beyond the soft skills that typically sell in interviews.

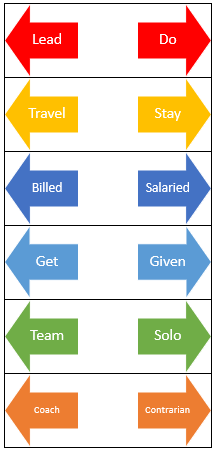

So , what are the characteristics you should look for in a fundraising operations staff member? Here are the ten that I have found most useful over the last 20 years:

Ten Characteristics of a Great Fundraising Operations Team Member

- Communication, interpretation and translation skills. This is the most basic skill. Clearly discussing needs and resources important to team members is an essential skill. The ability to listen, understand and translate discussions with end users is critical.

- Technical aptitude. Someone who understands relational databases or programming code in general can likely learn your organization’s details. Without such aptitude, the team member will struggle. This does not mean you should look for programmers but instead someone who could likely become one.

- Numeric aptitude. The ability to understand numbers is very important. For example, while few of your team members will ever write a $1 million check, they need to know that such a commitment is worth a thousand $1,000 checks. Or they need to understand that a $.20 cost to raise a dollar means a net return of 400 percent. They need to realize that a team that processes 250 gifts a day will not be able to handle your Giving Tuesday volume for weeks. They need to comprehend this order of magnitude to help realize the potential of fundraising.

- Appreciation for Fundraising. You need staff members who care about the mission, no matter their role in the organization. If you hear an operations team member talk about fundraising as “begging,” for example, that person needs training or a new job.

- Multitasking priorities. You need staff who can handle more than one project at a time. Operations should use business processes and protocols to handle priorities with accuracy and speed. And, there will be plenty of times where multiple priorities must be handled by COB. You want a colleague who remains cool and collected while closing out tasks.

- Discipline. The detail-oriented nature of many operations activities requires consistent application of rules and protocols. Team members need to be focused and dedicated to completing each task accurately.

- Creativity. Creativity in operations is often undervalued. Business processes should answer many questions and diminish the daily need for creative solutions, but the ability to solve exceptional cases will require creative thinking.

- Action-oriented. Another way to describe this trait is “ends-oriented.” You need team members who complete their work as a means to an end, which is greater activity and outcomes for fundraising. This is the combination of initiative and efficacy.

- Collegiality. Operations and frontline departments too frequently create an “us versus them” environment. You need staff members in operations and throughout the organization to believe fundraising is a team effort and who value all of their colleagues, no matter the role.

- Service-oriented. My survey data on department titles shows that “services” is an essential part of how teams are defined. From every employee, you should expect that they exude this characteristic.

Tips on Hiring Promising Candidates

One final, cumulative trait for candidates is that they can serve as an interpreter and liaison between all of the adjacent departments at your organization. Operations folks will talk with gift officers, accountants, IT developments, and others each day..Some of the work is functional and some is technical. A close colleague of mine, Roby Key, called these people “funci-techs”. You need folks who can hold (or at least sit in) a meeting with finance, IT, prospect management, and maybe the campaign committee in the same day. To understand if you have the right fit, ask questions like:

- “Describe a scenario where you had to communicate a complex idea to different audiences.”

- “Tell me about your training preferences and how you convince your trainees to apply what they’ve learned”

- “How do you think fundraising compares to other operations positions, such as banking, manufacturing, or sales management?”

Ideally, with the right characteristics and the right hiring steps, your team will soon have just the right team member—part function, part technical—to help your team align its tech and processes with its programs and people.

What have you found to be the most effective traits of, and ways to hire, operations talent? Post your thoughts in the comments. And, good luck with hiring!