Picture this: you have a count-down clock, ticking down with single digits left. Conversion of data has been tested. Training engaged the whole team. You’re ready for go-live….except you’re not. You’re not because Go-Live is, best case, just the middle of the process. And, this is a problem because:

- Leadership thinks the “go-live” means “project complete”.

- Finance thinks the fiscal spigot can be turned off.

- Field officers think they know just how to use the system.

- A raft of reports, business process re-engineering, and other steps remain.

- Oh, and you need to see whether the year-end procedures that work in principle will work in reality…in 9-12 months.

Expectation management that starts in #CRMSelection and carries through to #CRMImplementation must be an ongoing part of #CRMAdoption. For starters, system transitions (I often use “transition” or “replacement” to indicate that these changes are more than a conversion, etc.) have very long tails. Even though the volume of work happens in the first 1-2 years, another few years are often necessary to really refine, leverage, and optimize the new system. This means that, as one of my most contented and expert CRM clients experienced in their journey, a 5-year plan and budget is a smart way to go.

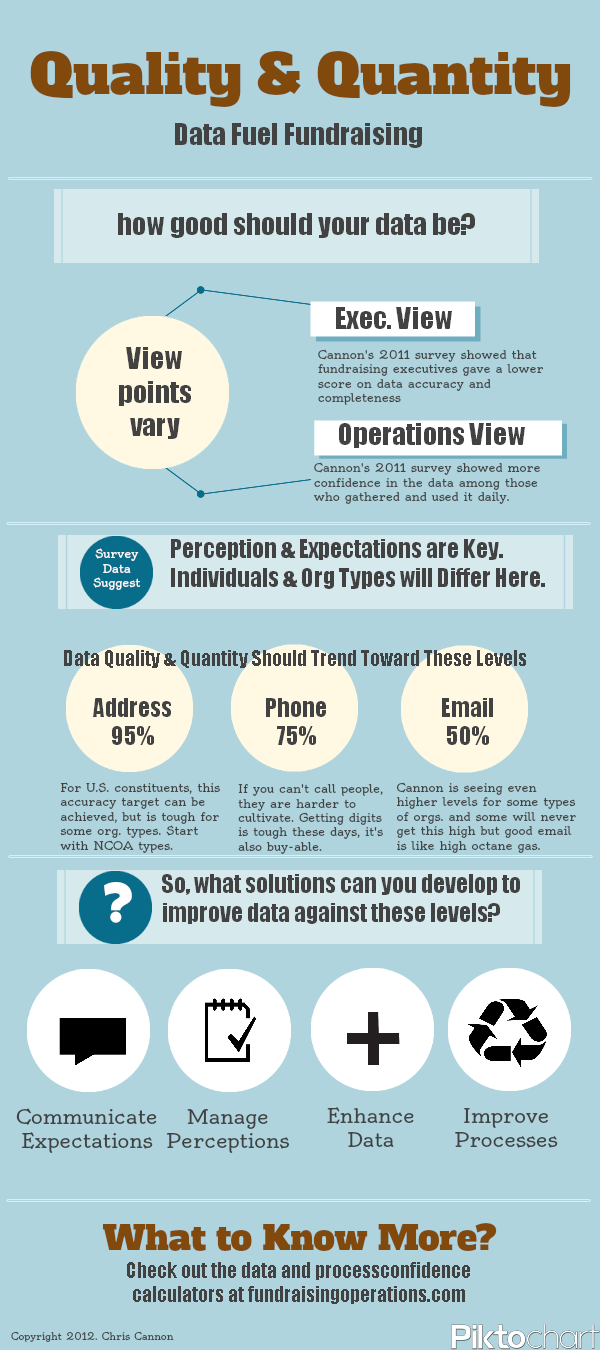

After good planning and a reasonable budget, the starting point for solid adoption is basic: great data. Trusted data, converted correctly from the old system. While this seems like a “didn’t go-live cover this” item, many of my clients find either issues for months or change their minds about data codes, locations, applications, etc. such that back-end global changes are necessary.

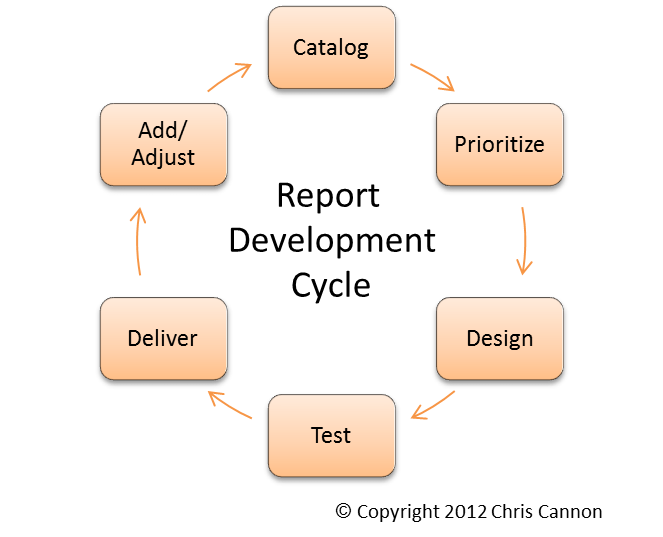

Reporting is often the epitome of post Go-Live pain point. It is hard for your colleagues to adopt the new database if they cannot get data outputs. My rule of thumb for any system transition is simply that “great reports mean great transitions”. Such reporting requires shared definitions, thoughtful calculations, mastery of new tools, and other benefits to long-term adoption.

Integrations with other systems present another likely post Go-Live adoption. Typically, things like the feed to Finance are ready to roll before conversion is complete. However, often patient feeds, student feeds, parent feeds, athletics feeds, online engagement tool feeds, etc. may not be in place at Go-Live. One client recently made the mistake of going live without a functioning feed to a high-volume gift generation foundation, only to be crippled by the extra dozen+ batches of gifts to manually handle each day.

Training is another core consideration for effective adoption. For starters, Training is not a spectator sport and should extend permanently after Go-Live. Training options should be varied (in-person, desk-side, computer-based) and be paired with accurate, update documentation. New staff on-boarding should be factored in.

Go-Live as the Middle of the Race

I’ve always been a fan of the explanatory power of metaphors and similes, especially sports metaphors. “Crossing the finish line,” “Being a good team member,” “Handing off the ball” all make complicated things clearer (for me at least). So here is a way to sum it up:

Go-Live is more like finishing the cycling leg of a triathlon. You haven’t crossed the finish line yet. The good news is you didn’t drown during #CRMSelection and now #CRMImplementation is mostly complete….but you still have a pesky marathon to run. Adoption requires all of those items above–data, reporting, integration, training–to be successful. And, too often, organizations go live well before they were ready for it.

Many say that a conversion is a marathon and not a sprint, but to fully transition to a new system, it’s more like a triathlon.

Do you have any good CRM-related metaphors? I’d love to hear ’em. ~Chris