At the AHP International Conference this week, Dan Lantz and I have the honor of exploring five key operations trends with a group of innovators. Whereas a few years ago “big data” and “analytics” were the buzz words for operations in our industry, five new innovations will matter most in 2016:

1) CRM. Constituent relations management is everywhere and on everyone’s minds. In practice, many nonprofits have a CRM but they may only be thinking of the heavily marketing online applications that are taking up a lot of head space for nonprofits. The trick is to avoid the hype and realize the promise of CRM–structured, comprehensive data and online engagement resources available to staff and constituents on-demand.

2) Data Integration. The promise of CRM is often stymied by the reality of unstructured data in many places. That Excel spreadsheet you keep for stewardship keeps you from realizing the benefits of CRM. The report you hand-create in powerpoint for the Board result in a disconnected set of information. Data integration requires first a commitment to a single source of truth and second an effort to automate and streamline as much of the data gathering and management as possible. Many in healthcare are realizing some benefits here for grateful family programs. Much more is available on the horizon.

3) Outsourcing. The professionalization of the operations side of advancement is moving our team members from mere “entry” to “analysis”, allowing for a growth in caging services. We are also seeing a move in the vendor space to cloud-based, hosted IT services. These outsourcing The more we can streamline the mundane tasks, the more our gift and data analysts can help us see patterns and better engage donors. Nonprofits are increasingly exploring the potential for outsourcing, which can be viewed as a very favorable thing. However, the organizational ramifications are significant so I expect many will not be too willing to explore this trend for fear of unsettling the work environment. That is a mistake. Our organizations deserve the highest functioning team members and, by removing the mundane from the day-to-day, you can cultivate a more engaged team.

4) Business Intelligence. BI is for many like a mythical unicorn on the hill. We have been talking about it for decades yet few have realized it. The notion–an integrated, complete set of data and reporting services that informs our business strategies while modeling our history–remains elusive but the tools available to support real BI have improved, as have great examples around the globe.

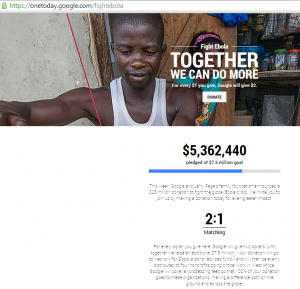

5) Social Data Management. If your organization does not yet have a social data management strategy, stop reading this and get started with one today. Beyond simply a Facebook post and engagement tactic, social data management requires that your organization do something strategic, systematic, and effective with the interactions. Ford pays Facebook $50 million a year for this sort of strategy…which means it may be a bit out of reach. However, you can start today by deciding when and how your team will not simply engage on social media but track and leverage what you learn for prospecting purposes.

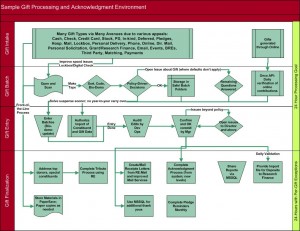

All of these innovations must be handled in light of the lack of investment we have as an industry for such strategies. We must use our revenue to support our missions, of course, yet this means that (as indicated in the image above) we have very little to spend on operations.

What other trends are going to affect us all in 2016? What is your organization experiencing? Dan and I would love to hear what you’re thinking so we can share it in Orlando. And, we’ll share the presentation later this week.